rhode island tax rates by town

15 Click tap or touch markers on the map. 2989 - two to five family residences.

Rhode Island Companies Will Face Higher Taxes Than China And Europe If Dem Bill Passes Americans For Tax Reform

41 rows West Warwick taxes real property at four distinct rates.

. Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets. Sales tax rates in Bristol County are determined by two different tax jurisdictions. Lowest sales tax 7 Highest sales tax.

Sales Tax Rank in US best 1 25. Providence RI Sales Tax Rate. 78 rows 2022 List of Rhode Island Local Sales Tax Rates.

Bristol County Rhode Island has a maximum sales tax rate of 7 and an approximate population of 40822. 2014 Tax Rates. MUNICIPALITY NOTES RRE COMM PP MV.

FY 2022 Rhode Island Tax Rates by Class of Property MUNICIPALITY NOTES RRE COMM PP MV BARRINGTON 2 1915 1915 1915 3000 BRISTOL 1438 1735. The rates are expressed in dollars per 1000 of. FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial.

Is Personal Property Taxable. 2022 Child Tax Rebate Program. Rhode Island property tax rates are set by cities and towns depending on the budget they require to provide their mandated services.

Rhode Island also has a 700 percent corporate income tax rate. Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 252882 RHODE ISLAND. BARRINGTON 2090 2090 2090 3500 BRISTOL 1407 1407.

Income Tax Brackets Rates Income Ranges and Estimated Taxes Due. Providence has a property tax. For example if your property is located in a Rhode Island city or town with a rate of 20 you would pay 20 for every 1000 of assessed value in property taxes.

Rhode Island has one of the highest average property tax rates in the country with only four states levying higher property taxes. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Effective Real-Estate Tax Rate.

FY 2021 Rhode Island Tax Rates by Class of Property. Detailed Rhode Island state income tax rates and brackets are available on. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Combined with the state sales tax the highest sales tax rate in Rhode Island is 7 in the. Portsmouth RI Sales Tax Rate. 39 rows Rhode Island Towns with the Highest Property Tax Rates.

NARRAGANSETTBonnett Shores 06551 06551 NORTH KINGSTOWNPojac Point 15200 15200 PORTSMOUTHPortsmouth Water Fire 02300 02300 RICHMONDHope. Rhode Islands median income is 73579 per year so the. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

Rhode Island Property Tax Rates for 2020 tax rate per thousand dollars of assessed value Click table headers to sort Tax Rates Markers. Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Yes Rhode Island State Website.

Lists Rhode Island Property Tax Rates

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Charlestown Commission Recommends Budget With Reduced Spending Level Tax Rate Charlestown Thewesterlysun Com

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

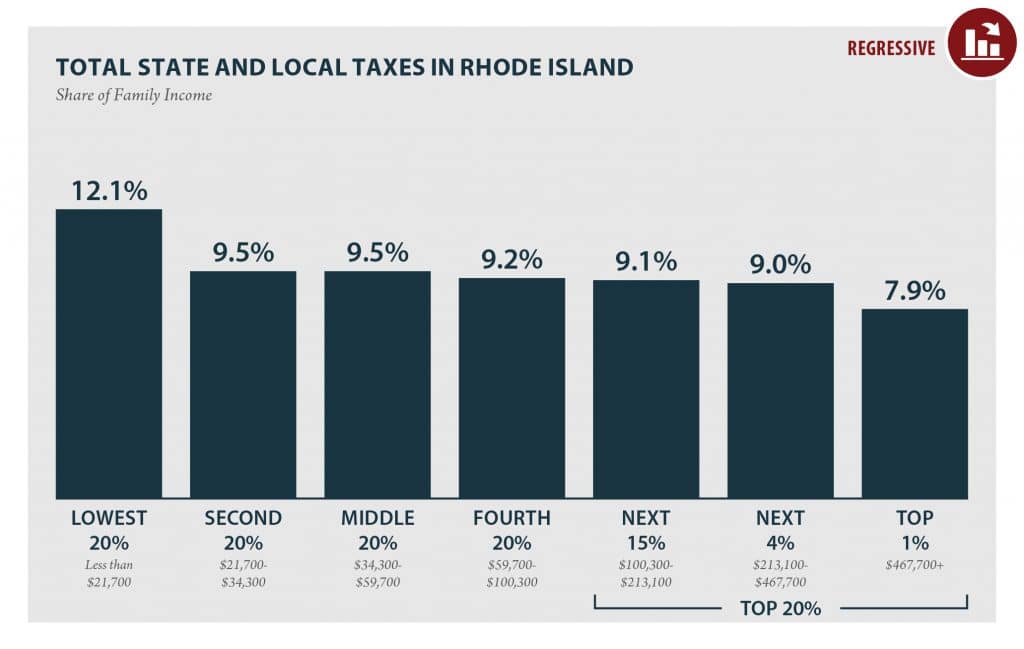

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Revenue For Ri Kicks Off Campaign To Tax The One Percent

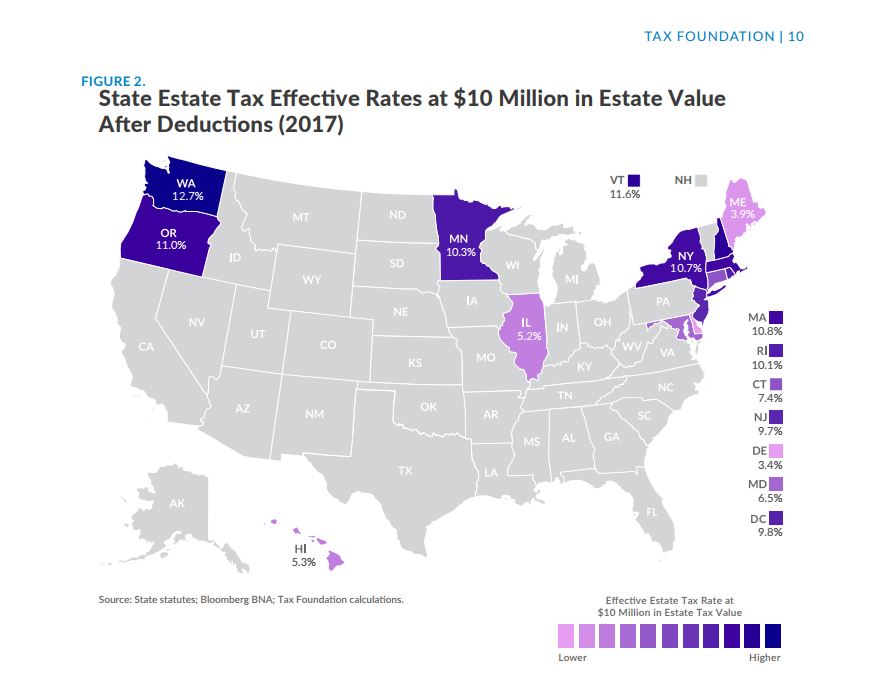

Tax Foundation R I Has 7th Highest Effective Estate Tax In Nation

Property Tax Calculator Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

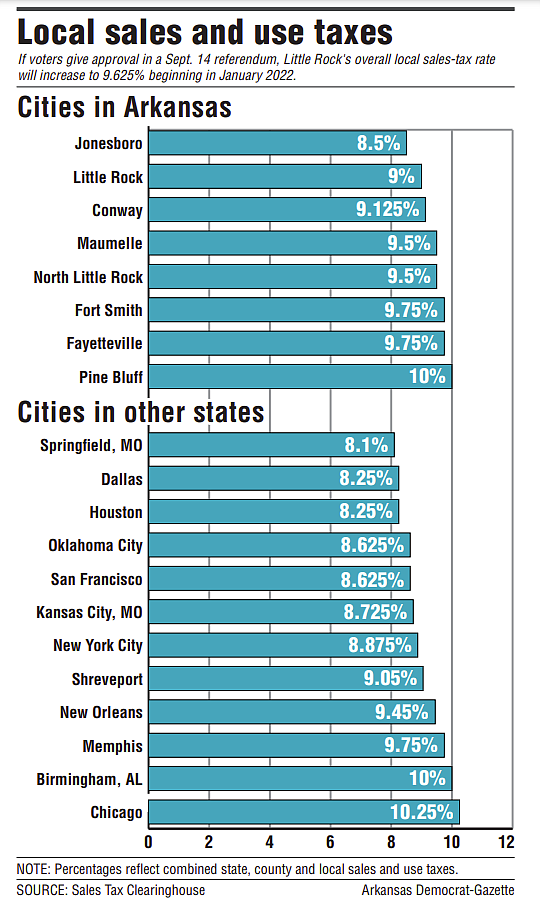

As Tax Rates Go Arkansas At Top

Top 5 Highest Lowest Property Tax Rates By Town In Rhode Island Youtube

Understanding Rhode Island S Motor Vehicle Tax

Form Sales Tax Rate Table Fillable 7 Tax Rate

Rhode Island Sales Tax Calculator Reverse Sales Dremployee

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns